J.P. Morgan Mozaic II℠ Index

An opportunity to pursue steady growth in a variety of markets

An opportunity for growth

The new J.P. Morgan Mozaic II℠ Index (the Index) utilizes some of the same investment philosophies used by the largest institutional investors seeking positive returns in both good and bad market environments. With a strategy to potentially generate consistent returns while managing volatility, the Index is founded upon three core principles:

J.P. Morgan, one of the world’s leading financial services firms, designed the Index to provide a diversified asset allocation with the opportunity to perform in growing and shrinking markets.J.P. Morgan, one of the world’s leading financial services firms, designed the Mozaic II℠ Index to provide a diversified asset allocation with the opportunity to perform in growing and shrinking markets. By targeting a volatility level of 4.2%, the index manages risk while providing the potential to generate consistent returns. The index may increase exposure to the underlying allocations up to 300% in lower volatility markets to help achieve the volatility target.1

For additional information about the index’s strategy and related risks, visit: https://www.jpmorganindices.com/indices/summary/JMOZAIC2

Helpful Resources

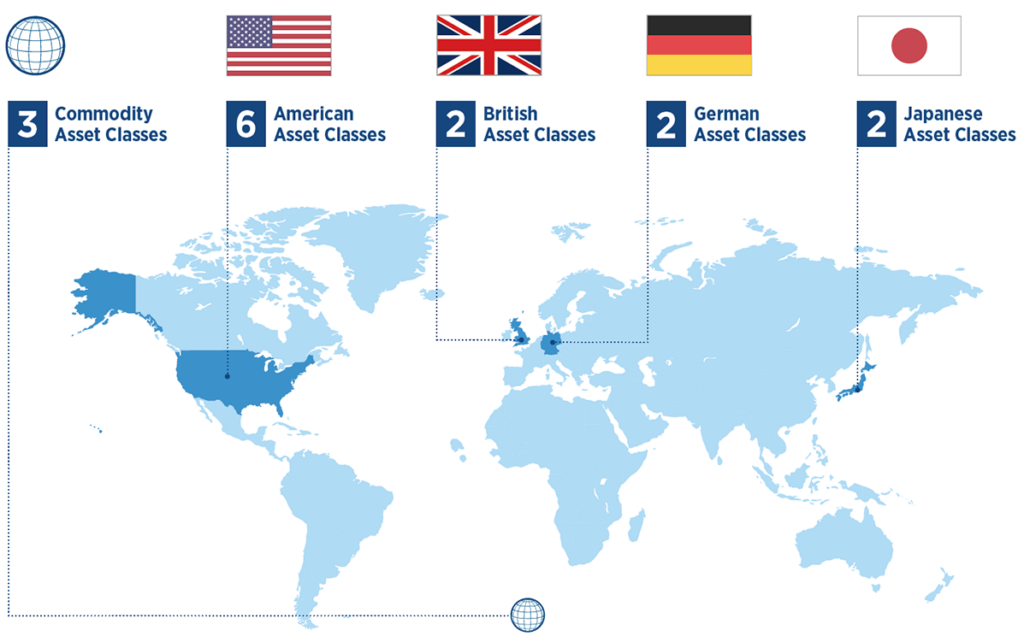

The benefit of a broadly diversified approach

A diversified asset selection strategy provides opportunities for growth through both traditional and alternative asset classes. The J.P. Morgan Mozaic II℠ Index’s diversification strategy leverages three essential elements:

The Index’s 15 asset classes are intended to provide flexibility to adapt to a variety of market conditions and help contribute to the Index’s consistent returns.

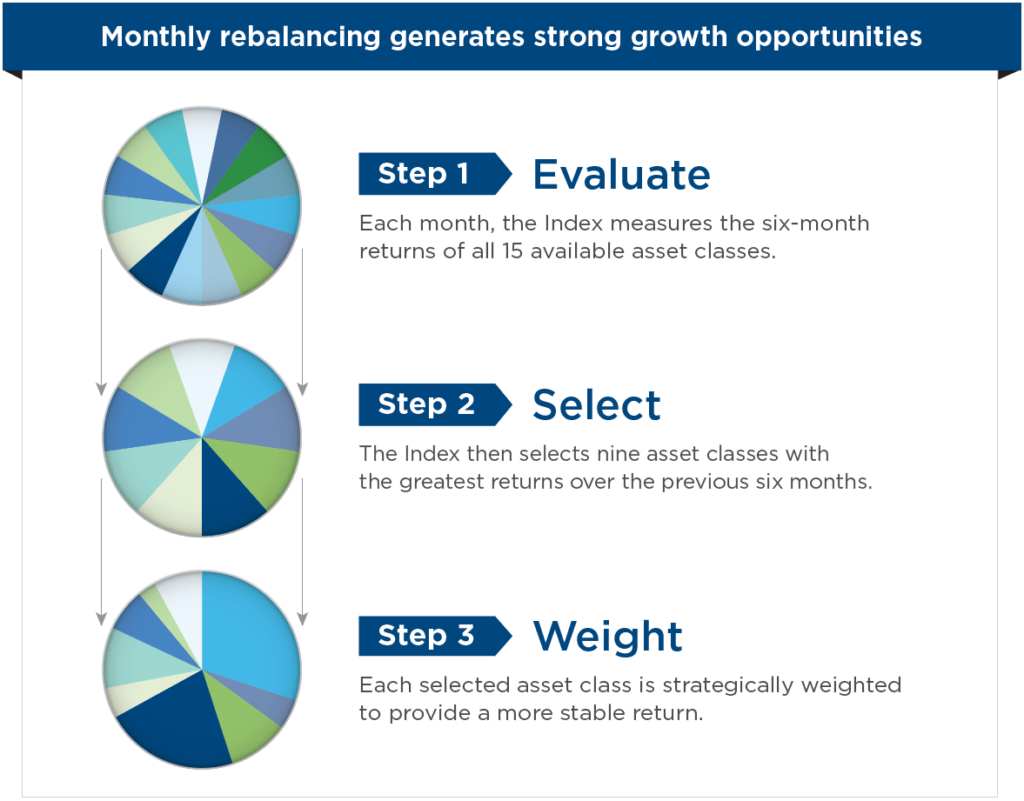

Monthly rebalancing capitalizes on performance

The J.P. Morgan Mozaic II℠ Index’s asset selection is based on the historic tendency for asset classes exhibiting recent returns to be more likely to continue to deliver performance. Each month the Index chooses nine asset classes exhibiting the highest returns and strategically allocates to each in order to smooth volatility within the Index and create more consistent returns.

“Stop-loss” feature: Asset classes are evaluated, selected and weighted monthly. If on any day the overall index’s weekly return is less than -3%, all allocations are removed for one week (the Index is effectively uninvested). After one week, the Index re-establishes allocations based on the monthly selection and weighting described above. This may reduce the risk of potential short-term loss in the Index during a period of significant market distress but may also cause the Index to miss a potential recovery in the underlying asset classes.

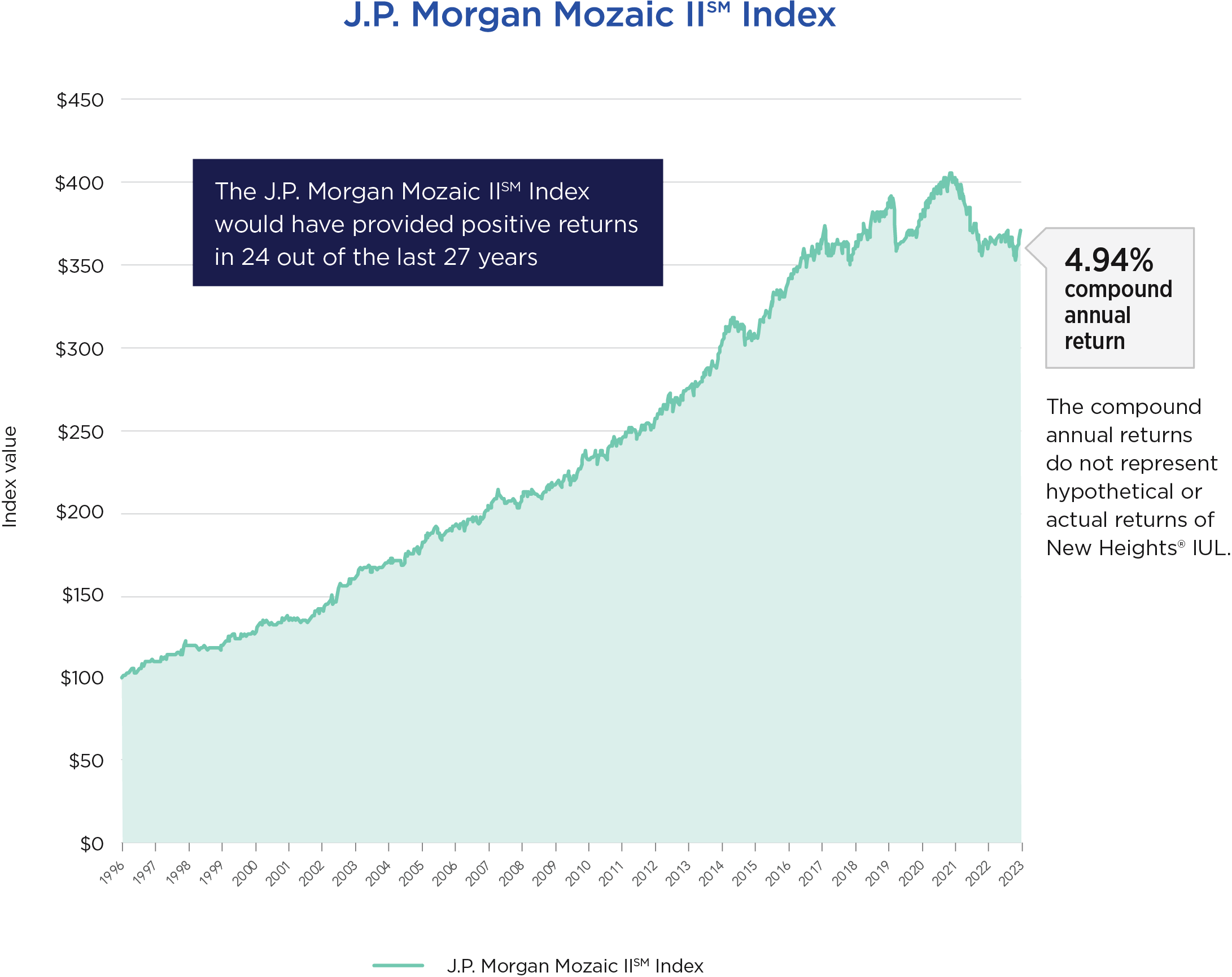

Smoothing volatility to create stable returns

The J.P. Morgan Mozaic II℠ Index would have provided steady growth through a variety of market environments due in part to a monthly allocation process intended to adapt to market changes and mitigate potential risks. The graph below shows how the J.P. Morgan Mozaic II℠ Index would have provided consistent positive returns with low volatility.

Hypothetical Assumptions: $100 invested in the J.P. Morgan Mozaic II℠ Index from 11/1/96 to 12/31/23. Note: The J.P. Morgan Mozaic II℠ Index was established on 12/28/16. Performance shown in years prior to this Index being created is back-tested by applying the J.P. Morgan Mozaic II℠ strategy to historical financial data when all components it uses were available. Certain components of the J.P. Morgan Mozaic II℠ Index were unavailable before 11/1/96. This Index was designed with the benefit of hindsight and knowledge of factors that may have positively affected performance. Back-tested performance is hypothetical and has been provided for informational purposes only. Past performance is not indicative of, nor does it guarantee, future performance. The J.P. Morgan Mozaic II℠ Index could under perform relative to other strategies. The hypothetical performance is calculated on an excess return basis.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

1Allocations over 100% will magnify positive or negative performance, which could affect the overall index performance. There’s no guarantee this methodology will achieve the target volatility or positive performance.

For more information on the J.P. Morgan Mozaic II℠ Index, please visit www.jpmorganindices.com.

The J.P. Morgan Mozaic II℠ Index uses volatility control methodologies. Volatility reference indices tend to limit index performance highs and lows which generally allows Nationwide to offer greater participation rates on indexed interest strategies in an indexed universal life insurance product compared to other strategies in the same product. There is no guarantee that selecting a volatility control indexed interest strategy will result in greater interest crediting than indexed interest strategies that do not use a volatility control index or that any interest will be credited for a particular index segment.

The J.P. Morgan Mozaic II℠ Index performance is calculated on an excess return basis which includes calculation elements that reduce index performance, including that it does not allocate to any interest-bearing cash rate allocations. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments.

The J.P. Morgan Mozaic II℠ Index (“Index”) has been licensed to Nationwide Life and Annuity Insurance Company (the “Licensee”) for the Licensee’s benefit. Neither the Licensee nor Nationwide New Heights® Indexed Universal Life Accumulator 2020 (the “Product”) is sponsored, operated, endorsed, recommended, sold or promoted by J.P. Morgan Securities LLC (“JPMS”) or any of its affiliates (together and individually, “JPMorgan”). JPMorgan makes no representation and gives no warranty, express or implied, to contract owners taking exposure to the Product. Such persons should seek appropriate professional advice before making any investment. The Index has been designed and is compiled, calculated, maintained and sponsored by JPMS without regard to the Licensee, the Product or any contract owner. JPMorgan is under no obligation to continue compiling, calculating, maintaining or sponsoring the Index. JPMorgan may independently issue or sponsor other indices or products that are similar to and may compete with the Index and the Product. JPMorgan may also transact in assets referenced in the Index (or in financial instruments such as derivatives that reference those assets). These activities could have a positive or negative effect on the value of the Index and the Product.

Nationwide New Heights Indexed Universal Life Accumulator 2020 (New Heights® IUL), indexed universal life insurance, is issued by Nationwide Life and Annuity Insurance Company, Columbus, Ohio.Indexed universal life insurance policies are not stock market investments, do not directly participate in any stock or equity investments, and do not receive dividends or participate in capital gains. Past index performance is no indication of future crediting rates.

All guarantees and benefits of the insurance policy are backed by the claims-paying ability of the carrier.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side and Nationwide New Heights are service marks of Nationwide Mutual Insurance Company. Third-party marks that appear in this message are the property of their respective owners. © 2024 Nationwide

FLW-0174AO.1 (3/24)