Plan today for a

tax-efficient retirement

New Heights® IUL provides a source of tax-free, supplemental retirement income

Grow and protect your retirement savings

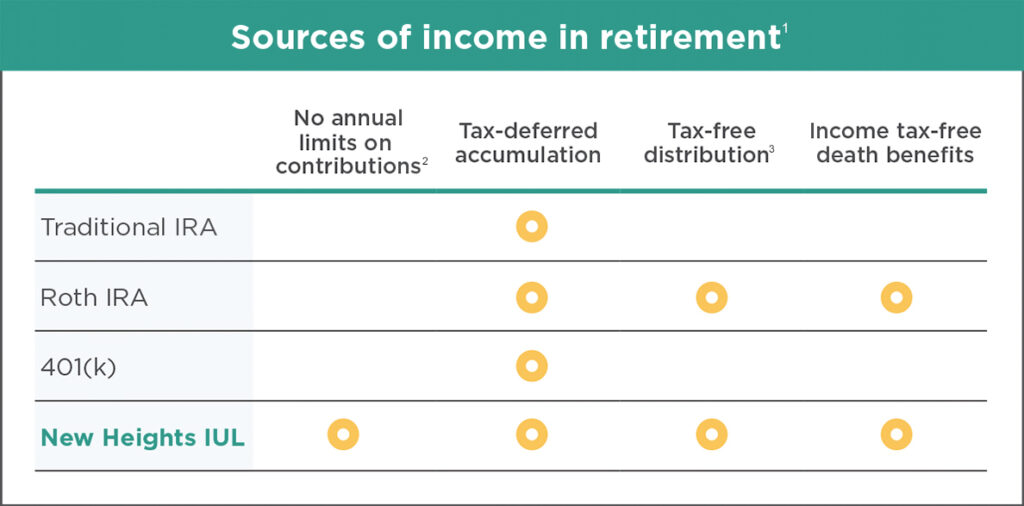

Traditional sources of retirement income like withdrawals from an IRA, 401(k) or pension are all taxable and could potentially reduce your disposable income in retirement. New Heights IUL provides a source of tax-free income that may help you qualify for a lower tax bracket and keep more of your retirement dollars working for you.

Maximize your retirement income efficiency

New Heights IUL offers an exclusive Automated Income Monitor service that can help you take income efficiently based on when and how you want to take it.4

You can also specify if you want to receive your income monthly, quarterly or annually based on your needs. A Review Package will be received on the policy anniversary to help you review your goals for the policy. This packet will include an Illustration to show you how the policy is performing.

1 Nationwide and its affiliates do not provide tax, legal or accounting advice. This material is offered for informational purposes only, is not intended to highlight all the features and benefits of each product and/or type of plan, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your tax, legal and accounting advisors before taking any action.

2 Retirement Plan annual contribution limits do not apply to life insurance. Premium may be limited to maintain qualification of the policy as life insurance or to prevent the policy from becoming a modified endowment contract (MEC). Distributions from a MEC may be taxable.

3 If you pay too much premium, your policy could become a modified endowment contract (MEC). Distributions from an MEC may be taxable.

4 With Automated Income Monitor, selecting the dollar amount of withdrawals will influence their duration (how long they last). Likewise, selecting a duration will influence the amount of the withdrawal. Either way, we will provide you the details and send you an annual update to keep you informed. Taking income out of your policy will reduce its cash value and may increase the chance it will lapse. If you plan to rely on your policy for income, ask your financial professional about using the Overloan Lapse Protection Rider to help keep your policy from lapsing.

Guarantees are subject to the claims-paying ability of the issuing insurer. Past index performance is no indication of future crediting rates. Also, be aware that interest crediting fluctuations can lead to the need for additional premiums to be paid into your policy.

Life insurance is issued by Nationwide Life and Annuity Insurance Company, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side and Nationwide New Heights are service marks of Nationwide Mutual Insurance Company. © 2022 Nationwide

FLW-0163AO.1 (01/22)