Goldman Sachs New Horizons Index

An opportunity for increased returns and diversification

Nationwide has licensed the Goldman Sachs New Horizons Index (the “Index”) for use in the Nationwide New Heights® Indexed Universal Life Accumulator 2020 (New Heights IUL)1. Nationwide has combined industry-leading best practices and a commitment to putting people first with an Index built upon academic principles. The result is a solution that uses forward-looking indicators and a unique group of assets focused on resiliency throughout evolving markets.

Helpful Resources

An opportunity for increased returns and diversification

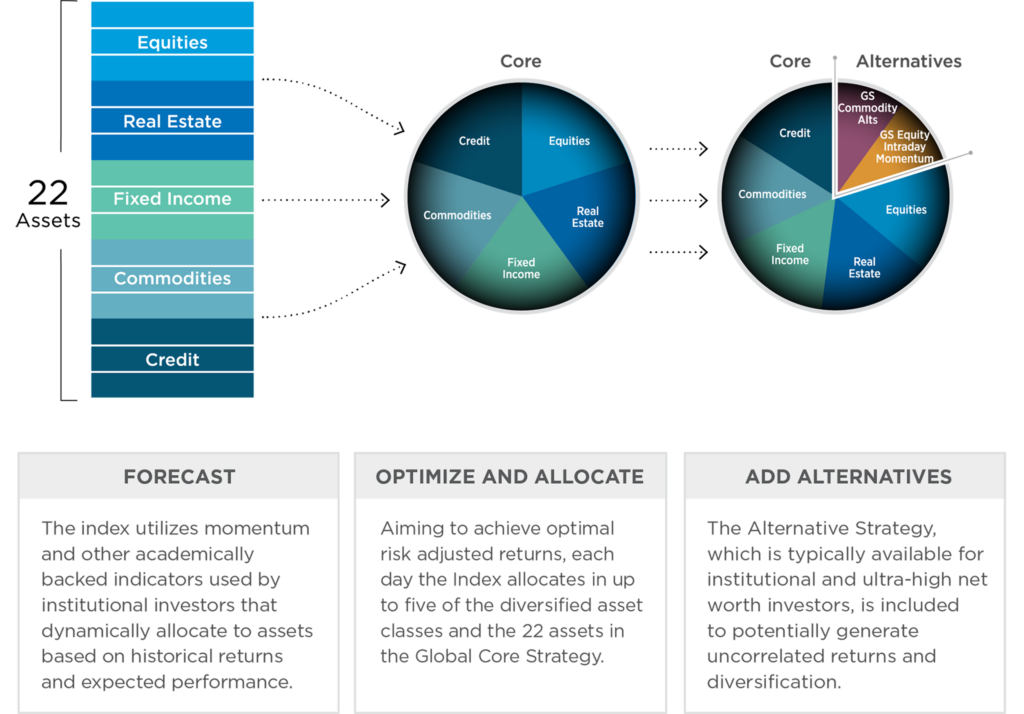

The Goldman Sachs New Horizons Index introduces the next frontier in terms of asset allocation—a Global Core Strategy and an Alternative Strategy—designed to potentially increase returns while improving diversification. The Index is guided by three key features:

Broad Diversification

The Global Core Strategy includes exposure to global equities, fixed income, commodities, credit and real estate for additional diversification and takes advantage of dynamic optimization.

Forward Looking

In addition to relying upon historical returns (“momentum”), the Index also incorporates forward looking indicators from institutional markets. It then uses this information to identify and systematically allocate to assets that are expected to perform well.

Alternative Allocations

The Index allocates to two alternative sub-strategies to diversify the exposure and potentially improve returns even during market downturns.

Access sophisticated, institutional-quality strategies

The broadly diversified Goldman Sachs New Horizons Index provides opportunities for growth through a Global Core Strategy and an Alternative Strategy. The Index features five asset classes and two alternatives that provide the flexibility to adapt to a variety of market environments and help contribute to the Index’s returns.

The Global Core Strategy

The Global Core Strategy is composed of 22 assets with exposure to five broadly diversified asset classes. These include equities across the US, Europe, Japan and Australia; bonds or other fixed-income investments across the US, Germany, Japan and Australia; commodities including gold, crude oil, copper and soybeans; credit that tracks investment grade and high yield corporate bonds in the US and Europe; and real estate in the US. The Strategy optimizes and allocates on a daily basis, aiming to smooth volatility and create more consistent returns.

The Alternative Strategy

Traditionally available for ultra-high net worth and institutional investors, the Alternative Strategy is composed of the GS Equity Intraday Momentum Strategy that monitors the US equity market and may rebalance every 30 minutes based on an intraday trend signal and the GS Commodity Alternative Strategy² that serves as an additional source of potential returns by exploring opportunities that might arise from the imbalance in trading by different commodities market participants.

An innovative approach backed by academic research

By allocating to both the Global Core Strategy and the Alternative Strategy, the Goldman Sachs New Horizons Index benefits from both traditional and alternative assets. The Global Core Strategy applies a Dynamic Optimization Process to potentially smooth volatility and create more consistent returns, while the Alternative Strategy provides an additional growth opportunity.

Dynamic Optimization and Allocation Process

The Goldman Sachs New Horizons Index further rebalances daily to meet its 5% volatility control level. This daily re-allocation aims to further reduce risk when markets are volatile. While this can lessen the impact of market downturns, it may also limit upside potential.

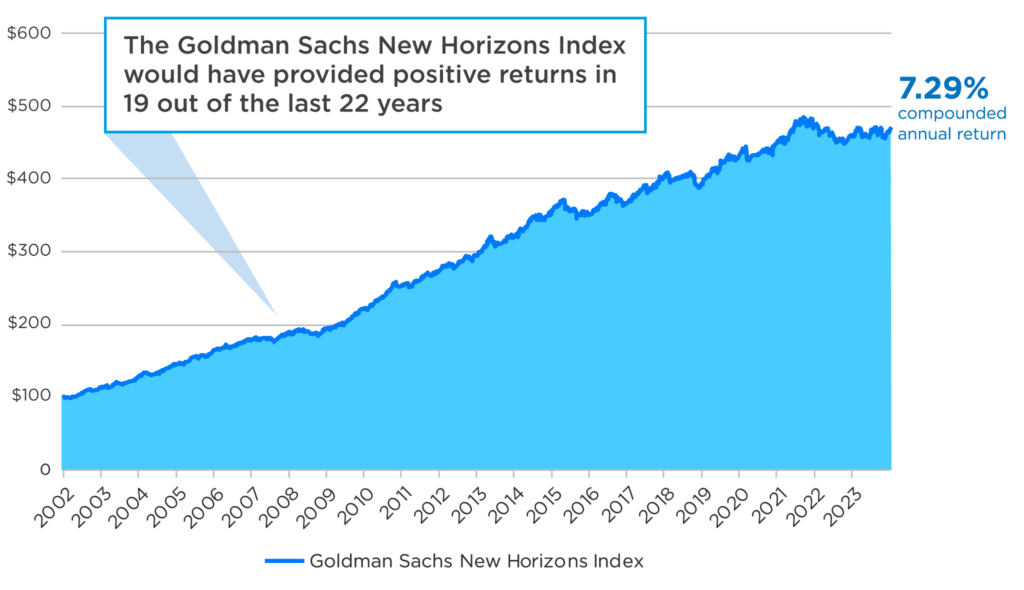

Dynamic rebalancing to potentially smooth returns

The Goldman Sachs New Horizons Index would have provided steady growth through a variety of market environments due to its Dynamic Optimization Process of the Global Core Strategy and the addition of Alternatives. It is important to note that the graph below shows the hypothetical performance of the Index using back tested data. Back-tested data is not indicative of future results.

Hypothetical Historical Performance of

Goldman Sachs New Horizons Index

Hypothetical assumptions: $100 invested in Goldman Sachs New Horizons Index from 1/4/02 to 12/31/23. The Goldman Sachs New Horizons Index was established on 3/2/2022. Performance shown in years prior to this Index being created is back-tested by applying the Goldman Sachs New Horizons Index strategy to historical financial data when all components it uses were available. Certain components of the index were unavailable before March 2007. Back-tested performance is hypothetical and has been provided for illustrative purposes only and reflects a 0.50% per year index fee along with servicing and rebalancing costs. This Index was designed with the benefit of hindsight and knowledge of factors that may have positively affected performance. Past performance is not indicative of, nor does it guarantee, future performance. The Goldman Sachs New Horizons Index could under-perform relative to other strategies. The hypothetical performance is calculated on an excess return basis.

Not a deposit • Not FDIC or NCUSIF insured • Not guaranteed by the institution • Not insured by any federal government agency • May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

1 Goldman Sachs New Horizons Index (Index) is one of the index options available with the New Heights IUL, a life insurance product from Nationwide.

Guarantees are subject to the claims-paying ability of the issuing insurer. Be sure to choose a product that meets long-term life insurance needs, especially if personal situations change — for example, marriage, birth of a child or job promotion. Weigh the costs of the policy, and understand that life insurance has fees and charges that vary with sex, health, age and tobacco use.

Indexed universal life insurance policies are not stock market investments, do not directly participate in any stock or equity investments and do not receive dividends or capital gains participation. Past index performance is no indication of future crediting rates. Also, be aware that interest crediting fluctuations can lead to the need for additional premiums to be paid into your client’s policy.

The Goldman Sachs New Horizons Index uses volatility control methodologies. Volatility control reference indices tend to limit index performance highs and lows which generally allows Nationwide to offer greater participation rates on indexed interest strategies in an indexed universal life insurance product compared with other strategies in the same product. There is no guarantee that selecting a volatility control indexed interest strategy will result in greater interest crediting than indexed interest strategies that do not use a volatility control index or that any interest will be credited for a particular index segment.

The Goldman Sachs New Horizons Index performance information reflects a 0.50% per annum deduction rate along with replicating and rebalancing costs which will reduce the level of the index. In addition, this is an excess return index which includes calculation elements that reduce index performance, including that it does not allocate to any interest-bearing cash rate allocations. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments.

The Goldman Sachs New Horizons Index targets volatility level of 5%. The index may increase exposure to the underlying allocations up to 300% in lower volatility markets to help achieve the volatility target. Allocations over 100% will magnify positive or negative performance which could affect the overall index performance. There’s no guarantee this methodology will achieve the target volatility or positive performance. For additional information about the index’s strategy and related risks, see: https://www.goldmansachsindices.com/products/GSNHRZON

This product is not sponsored, endorsed, sold, guaranteed, underwritten, distributed or promoted by Goldman Sachs & Co. or any of its affiliates (including Goldman Sachs Asset Management, L.P.), with the exception of any endorsement, sales, distribution or promotion of this product that may occur through its affiliates that are licensed insurance agencies (excluding such affiliates, individually and collectively, “Goldman Sachs”) or its third party data providers. Goldman Sachs and its third party data providers make no representation or warranty, express or implied, regarding the advisability of purchasing life insurance products generally or in this product or in the investment strategy underlying this product particularly, the ability of the Goldman Sachs New Horizons Index (the “Index”) to perform as intended, the merit (if any) of obtaining exposure to the Goldman Sachs New Horizons Index or the suitability of purchasing or holding interests in this product. Goldman Sachs and its third party data providers do not have any obligation to take the needs of the holders of this product into consideration in determining, composing or calculating the Goldman Sachs New Horizons Index. GOLDMAN SACHS DOES NOT GUARANTEE THE ADEQUACY, TIMELINESS, ACCURACY AND/OR COMPLETENESS OF GOLDMAN SACHS NEW HORIZONS INDEX OR OF THE METHODOLOGY UNDERLYING THE INDEX, THE CALCULATION OF THE INDEX OR ANY DATA SUPPLIED BY IT FOR USE IN CONNECTION WITH THIS PRODUCT. GOLDMAN SACHS HEREBY EXPRESSLY DISCLAIMS ANY AND ALL LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN OR IN THE CALCULATION THEREOF. GOLDMAN SACHS EXPRESSLY DISCLAIMS ALL LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGE EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

THIRD PARTY DATA IS USED UNDER LICENSE AS A SOURCE OF INFORMATION FOR GOLDMAN SACHS NEW HORIZONS INDEX. THIRD PARTY PROVIDER HAS NO OTHER CONNECTION TO GOLDMAN SACHS INDEXES AND SERVICES AND DOES NOT SPONSOR, ENDORSE, RECOMMEND OR PROMOTE ANY GOLDMAN SACHS INDEX OR SERVICES. THIRD PARTY PROVIDER HAS NO OBLIGATION OR LIABILITY IN CONNECTION WITH THE GOLDMAN SACHS INDEX AND SERVICES. THIRD PARTY PROVIDER DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF ANY MARKET DATA LICENSED TO GOLDMAN SACHS AND SHALL NOT HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN THIRD PARTY PROVIDER AND GOLDMAN SACHS.

‘Goldman Sachs,’ ‘Goldman,’ ‘Goldman Sachs New Horizons Index’ are trademarks or service marks of Goldman Sachs & Co. and have been licensed for use by Nationwide Life and Annuity Insurance Company for use in connection with this product.

The Goldman Sachs New Horizons Index performance information reflects a 0.50% per annum deduction rate, and servicing (based on notional positions) and rebalancing (based on turnover) costs at rates that vary based on the underlying assets at the Goldman Sachs New Horizons Index level and also within certain underlying assets, but there may be additional fees and costs that are separately applied to this product. Because certain costs are based on both turnover and a market-based rate, such costs are not predictable and may increase substantially in the future, especially during periods of market stress. Further, the deduction rate and costs will reduce the potential positive change in the Goldman Sachs New Horizons Index performance and increase the potential negative change in the Goldman Sachs New Horizons Index performance.

Life insurance is issued by Nationwide Life and Annuity Insurance Company, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, Nationwide New Heights are service marks of Nationwide Mutual Insurance Company. Third-party marks that appear in this message are the property of their respective owners. ©2024 Nationwide

Policy Form #: ICC 18-NWLA-558

Nationwide New Heights IUL Accumulator 2020

FLW-0175AO.1 (03/24)