“Behavioral finance could be the key to higher returns with less risk.”

Roger G. Ibbotson, PhD.

The NYSE® Zebra Edge® Index

An opportunity for consistent returns using behavioral finance

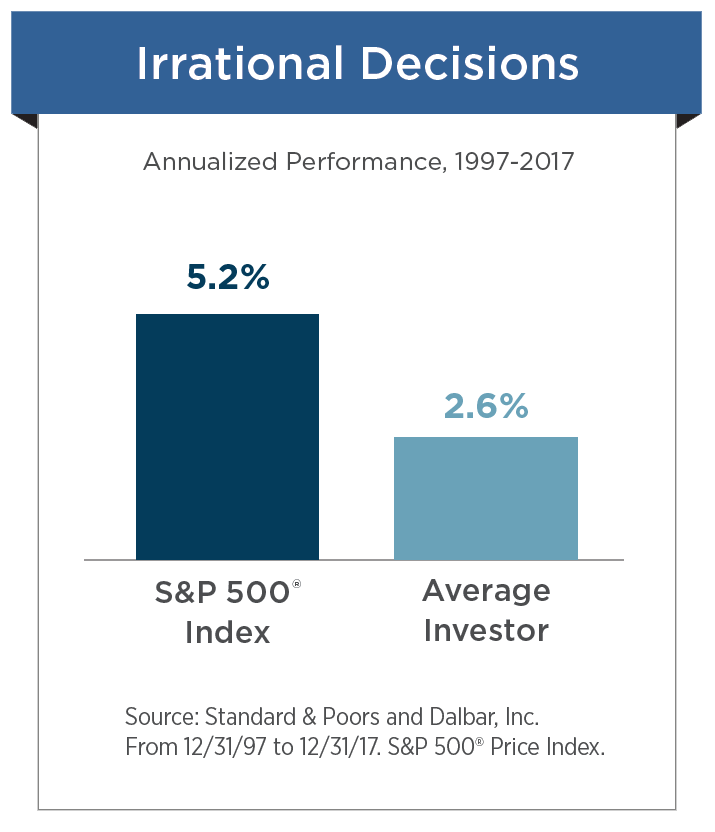

Behavioral finance is a field of economics that applies insights from cognitive psychology to reveal how and why people make investment decisions. Renowned economist Professor Roger Ibbotson and the team at Zebra applied behavioral finance to the equity markets and discovered that:

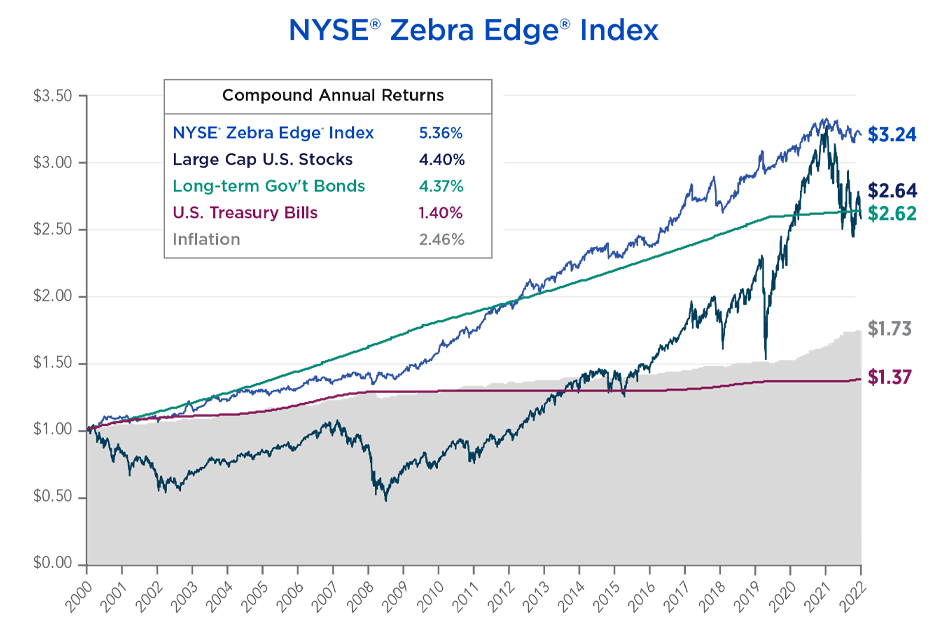

Zebra’s research methodology is combined with a daily risk control methodology to create the NYSE® Zebra Edge® Index, a rules-based index designed to potentially provide higher returns with less risk by avoiding overpriced, popular stocks and selecting undervalued equities with less volatility.

The NYSE Zebra Edge Index is one of the options available in the Nationwide New Heights® Indexed Universal Life Accumulator 2020 (New Heights® IUL), a life insurance product from Nationwide. This web page was designed to provide information about the index. It does not describe the features or historical crediting rates of the product. The crediting rate applied in the life insurance product is subject to additional factors such as participation and floor rates. For more information on the New Heights® IUL, please ask your financial professional for a product brochure.

Helpful Resources

Ibbotson’s behavioral finance filtering process

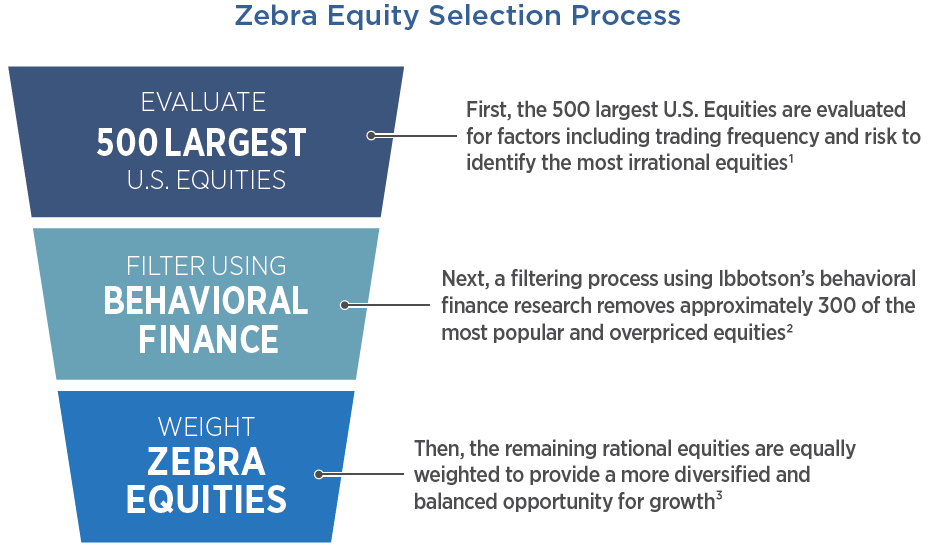

The NYSE® Zebra Edge® Index evaluates the 500 largest publicly traded companies in the United States each quarter and removes the riskiest and most volatile companies.2 The diagram below shows how every three months the NYSE® Zebra Edge® Index selects rational equities with the potential for higher returns with less risk.

The NYSE® Zebra Edge® Index applies a volatility control methodology that makes daily allocation adjustments to three things: 1) Zebra Equities minus a short-term financing rate, 2) U.S. Treasury Futures, and 3) an interest-free cash account. This daily reallocation is designed to further reduce risk by maintaining a target volatility level of 5.0%. The index may increase exposure to the underlying allocations up to 150% in lower volatility markets to help achieve the volatility target.4

The benefit of a rational long-term strategy

Over the last 20 years, U.S. Treasury Bills have failed to keep pace with inflation, and Large Cap U.S. Stocks have experienced significant drawdowns, reducing returns. Long-term bonds have been consistent, but today’s interest rates are near historic lows. The NYSE® Zebra Edge® Index rational equity strategy would have provided more stable returns.

Source: S&P Dow Jones, Board of Governors of the Federal Reserve System (US), NYSE®, 2022 SBBI Yearbook (Roger G Ibbotson, Duff, & Phelps), and the CPI Index. Growth of $1.00 7/6/00 to 12/30/22. Large Cap Stocks (as represented by the S&P 500® Price Index), Long-term Gov’t Bonds (as represented by 10-year Treasuries), U.S. Treasury Bills and Inflation results are actual for the full period and are not risk controlled (if applicable). Long-term Gov’t Bonds and U.S. Treasury Bills are guaranteed by the U.S. government.

The NYSE® Zebra Edge® Index was established on 10/11/2016. Performance shown in years prior to this Index being created is back-tested by applying the NYSE® Zebra Edge® to historical financial data when all components it uses were available. Certain components of the NYSE® Zebra Edge® Index were unavailable before 7/6/00. Back-tested performance is hypothetical and is provided for illustrative purposes only. This Index was designed with the benefit of hindsight and knowledge of factors that may have positively affected performance. Past performance is not indicative of, nor does it guarantee, future performance. The NYSE® Zebra Edge® Index could under-perform relative to other equity investment strategies. The hypothetical performance is calculated on an excess return basis.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

1 The 500 largest publicly traded companies in the United States as represented by the NYSE® U.S. Large Cap Equal Weight Index.

2 The equities with the highest volatility over the previous three months and prior year are removed, and equities with the highest trading frequency are removed.

3 Approximately 200 Zebra Equities are selected through this quarterly selection process. The selection process occurs in February, May, August and November.

4 Allocations over 100% will magnify positive or negative performance which could affect the overall index performance. There’s no guarantee this methodology will achieve the target volatility or positive performance.

Volatility control reference indices tend to limit index performance highs and lows which generally allows Nationwide to offer greater participation rates on indexed interest strategies in an indexed universal life insurance product compared to other strategies in the same product. There is no guarantee that selecting a volatility control indexed interest strategy will result in greater interest crediting than indexed interest strategies that do not use a volatility control index or that any interest will be credited for a particular index segment. For additional information about the index’s investment strategy and related risks, see the index brochure at https://www.nyse.com/publicdocs/nyse/indices/NYSE_Zebra_Edge_Index_Brochure.pdf.

This material is not a recommendation to buy, sell, hold, or roll over any asset, adopt a financial strategy or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition or particular needs of any specific person. Clients should work with their financial professional to discuss their specific situation.

Nationwide New Heights IUL Accumulator 2020, an indexed universal life insurance policy, is issued by Nationwide Life and Annuity Insurance Company, Columbus, Ohio. Indexed universal life insurance policies are not stock market investments, do not directly participate in any stock or equity investments, and do not receive dividends or participate in capital gains. Past index performance is no indication of future crediting rates.

All guarantees and benefits of the insurance policy are backed by the claims-paying ability of the issuing carrier.

The NYSE® Zebra Edge® Index performance is calculated on an excess return basis which includes calculation elements that reduce index performance, including that it does not allocate to any interest-bearing cash rate allocations. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments.

The NYSE® Zebra Edge® Index has been licensed by ICE Data Indices, LLC (together with its subsidiaries and affiliates, “IDI”) to UBS AG and sub-licensed by UBS AG (together with its subsidiaries and affiliates, “UBS”) to Nationwide Life and Annuity Insurance Company (“Nationwide”). Neither Nationwide nor the Nationwide New Heights® Indexed Universal Life Accumulator 2020 (the “Product”) is sponsored, operated, endorsed, recommended, sold or promoted by Zebra Capital Management, LLC (together with its affiliates and subsidiaries, “Zebra”), IDI or UBS and in no event shall Zebra, IDI or UBS have any liability with respect to the Product or the Index. Zebra, IDI and UBS make no representations, give no express or implied warranties and have no obligations with regard to the Index, the Product or otherwise to any investor in the Product, client or other third party. The mark NYSE® is a registered trademark of NYSE Group, Inc., Intercontinental Exchange, Inc. or their affiliates and is being utilized by ICE Data Indices, LLC under license and agreement. The marks Zebra® and Zebra Edge® are registered trademarks of Zebra Capital Management, LLC, may not be used without prior authorization from Zebra Capital Management, LLC, and are being utilized by ICE Data Indices, LLC under license and agreement.

The “S&P 500” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Nationwide Life and Annuity Insurance Company (“Nationwide”). Standard & Poor’s®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); DJIA®, The Dow®, Dow Jones® and Dow Jones Industrial Average are trademarks of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Nationwide. Nationwide New Heights® IUL Accumulator 2020 is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide New Heights are service marks of Nationwide Mutual Insurance Company. Third-party marks that appear in this message are the property of their respective owners. © 2023 Nationwide

FLW-0173AO (12/23)